Property Rights, Markets, and Human Progress

In my last post, I talked about how prices give us both a signal and an incentive. A falling price tells a producer that a good is needed less, and so that producer will direct resources elsewhere, where the profits are higher. A rising price tells a producer that a good is needed more, and so that producer will direct resources to making more of that good to take advantage of the profit opportunity. The price system makes self-interest work for the common good.

But all this assumes that we have private property rights. If I have a stock of lumber in a warehouse in Oregon, and I hear that a hurricane in New Jersey is causing prices to spike there, I have an incentive to ship lumber there only if I can enjoy the profits of doing so. If the government taxes my profits at 100%, I have no incentive to ship the lumber where it’s needed most. Even if the tax is only 70% or 60%, it reduces my incentives enough that I’m not going to incur a lot of time, effort, and cost to ship the lumber. Similarly, if the government owns the lumber, or no one does, then no one earns the profit from shipping the lumber where it’s needed, and so no one wants to ship the lumber where it’s needed.

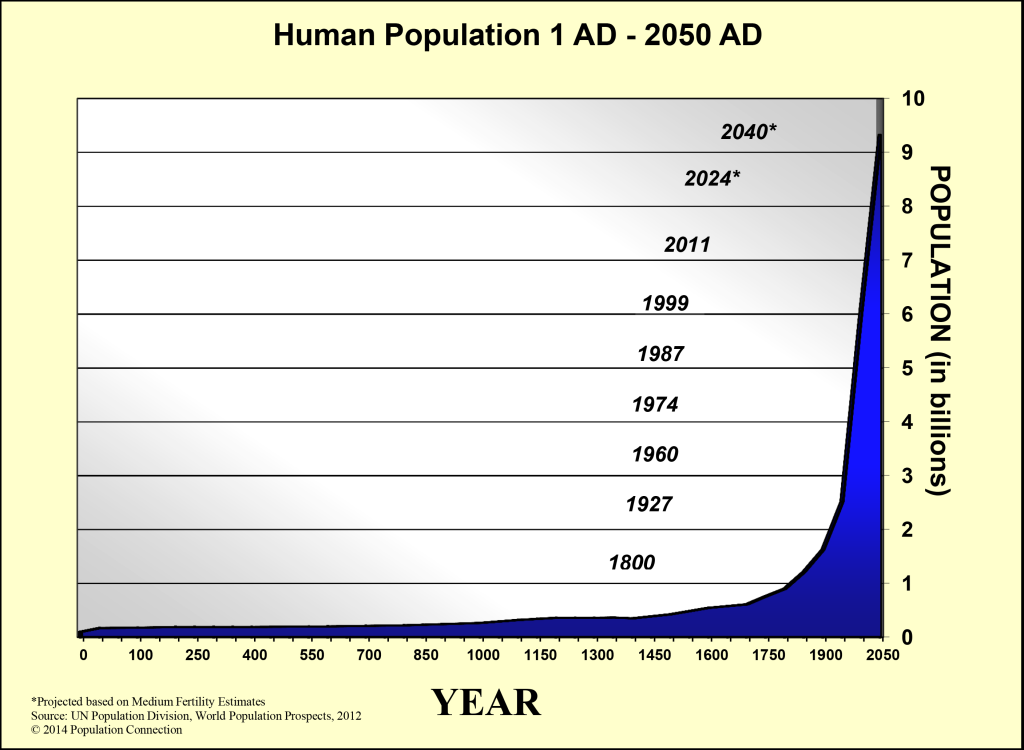

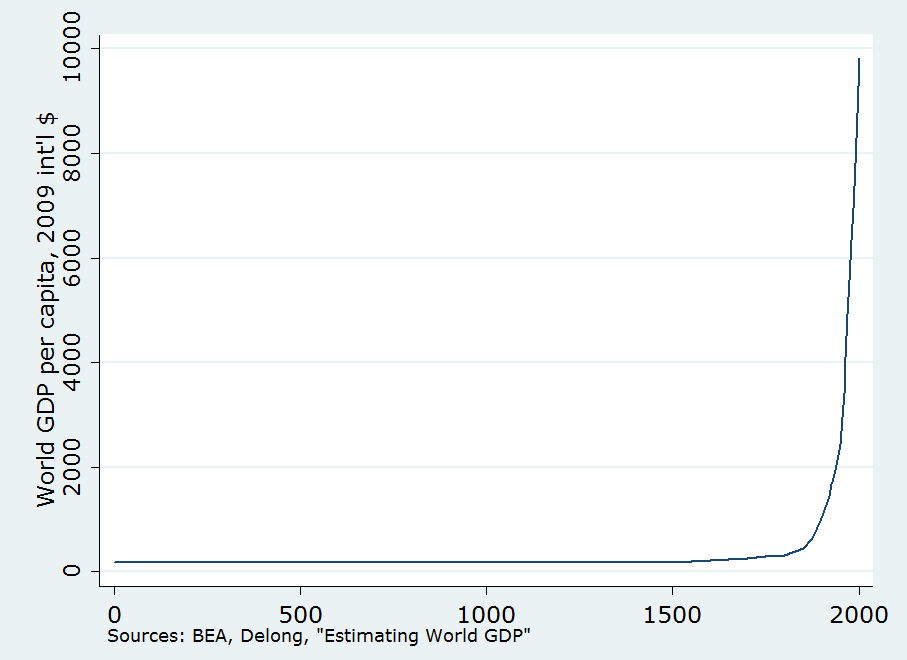

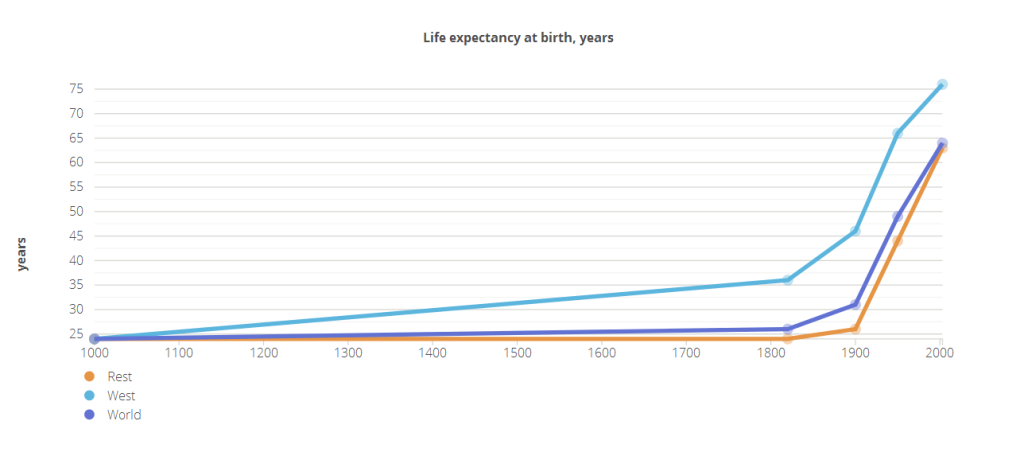

Human progress requires both markets and private property rights. Take a look at these charts of human population, gross domestic product per person, and life expectancy over time.

Human population, prosperity, and health started to rise, bit by bit, with the expansion of markets and trade from 500 BC to 500 AD in the Mediterranean region. Then it started rising again in late medieval and early modern Europe. The real explosion occurred, however, after 1800, and is associated with the Industrial Revolution. In each case, the expansion of markets drove human progress, and property rights were a critical ingredient in the recipe.

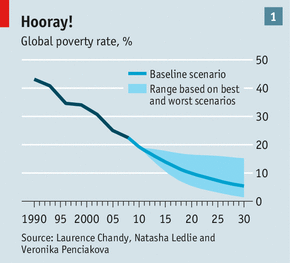

To see this, look at how China has grown since abandoning totalitarian socialism for a more market-oriented model, in which some people can move freely to new places, start businesses, and even become wealthy. China’s growth success has been so significant that it has driven down world poverty rates substantially:

The number of people living on less than $1.25 a day in today’s money has declined from 88% of China’s population in 1981 to just 7% by 2012. Over 660 million people in China have risen out of poverty due to the country’s economic progress.

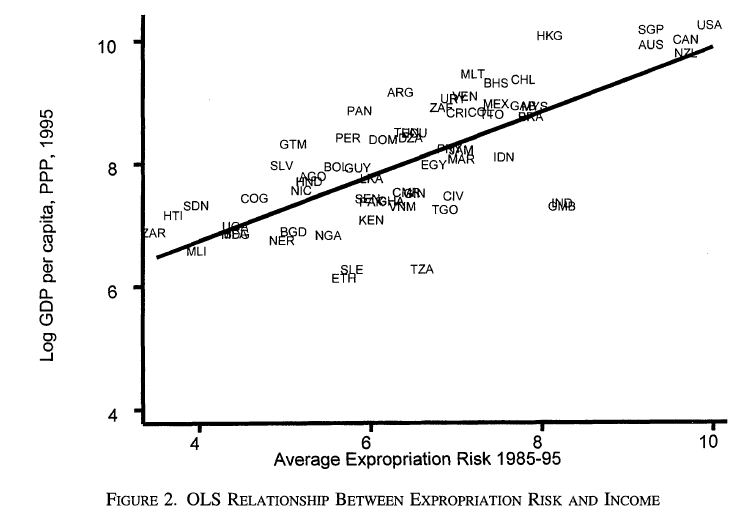

In their research, MIT economist Daron Acemoglu and Harvard economist James Robinson have found that “protection from expropriation risk” correlates statistically significantly with per capita income across countries, and the effect seems to be causal. In other words, protecting private property rights promotes economic growth. The plot below comes from one of their famous articles with Simon Johnson: the X axis shows degree of property rights protection (higher numbers are better), the Y axis shows income per person.

One puzzle remains. If private property rights are so great for the economy, why didn’t the economy grow tremendously during the age of classic feudalism, when aristocrats held absolute property rights in their land, and serfs had to work on their estates for low pay? It should be clear that just as prices without property rights do little good, so do property rights without real markets. When a small group of people own vast quantities of land and use their ownership of land to oppress everyone else, you won’t get economic progress. We need private property rights, but they need to be dispersed enough to prevent the biggest property owners from converting their wealth into effectively absolute political power.

I was thinking about the intersection between a free-market economy and a democratic government. Is it possible for an oligarchy or a similar system to have a true free market, and vice versa? According to this recent article ( http://www.washingtontimes.com/news/2014/apr/21/americas-oligarchy-not-democracy-or-republic-unive/ ), America is more than an oligarchy than a democracy. With such a dense conglomeration of resources, many of the wealthiest people have a significant amount of political power in the US political system, which is similar to the feudalism example that you gave at the end of your post. While the US was created upon the ideals of democracy, in today’s political landscape many of these ideals, such as the power of an individual’s votes, have a small amount of power, and I hope that, through new economic or political policies, this phenomenon will be diminished in power.

Thanks, Lindsay. In the U.S., we still don’t know why the wealthy are more influential than those lower down the income scale. One reason could be that higher-income people tend to be more active in politics and more knowledgeable about it. Another is that they travel in the same social circles as many politicians, went to the same universities, etc. There’s no doubt that American society has become elite-driven, and that includes politics. We don’t all have an equal say.